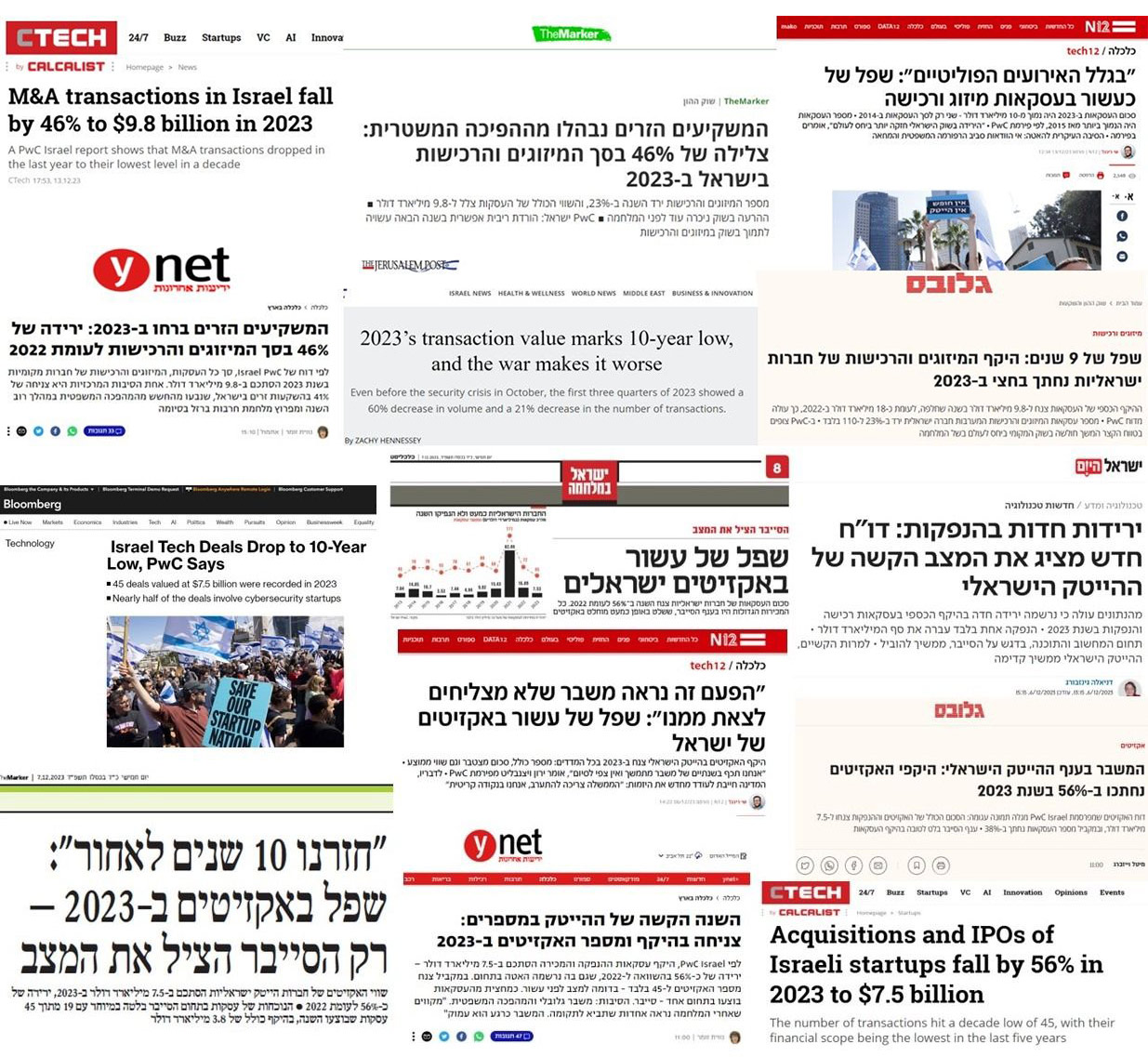

PwC Israel concludes 2023 with the annual reports – the Exits Report and the Mergers and Acquisitions Report in the Israeli economy

PwC Israel presents data that has not been seen in a decade in Israel, both in the high-tech exits sector and in mergers and acquisitions transactions across various sectors. The findings of these reports are related, among other things, with the instability in the Israeli reality over the past year.

So, what defined the year in the tech sector? According to the 2023 Exits Report, the total value of acquisition and IPO transactions amounts to $7.5 billion, with only 45 transactions. On the contrary, the cybersecurity sector salvaged the situation with 19 transactions totaling approximately $4.2 billion, and Israeli transactions continue to be a significant segment of the report.

And how was the year in the Israeli market from a macroeconomic perspective? According to the 2023 Mergers and Acquisitions Report, presenting the state of the Israeli economy against the backdrop of uncertainty in the socio-political reality of the country, there is a trend of decline in more robust transactions compared to the global status. Despite the global crisis influenced by inflation and interest rate hikes, the high-tech sector continues to lead with 81% of all transactions. Another finding indicates a 46% decrease in the total value of transactions; a 23% decrease in the number of transactions, with a total sum of $9.8 billion; and a 35% drop in the average transaction value estimated at $131 million. However, despite the challenging environment, transactions that reached the closing stage were indeed closed successfully.

Looking to the future, there is an optimistic outlook within the industry regarding the recovery of the Israeli economy, which is valuable for the global market in technological aspects and beyond. The interest of investors in Israel emphasizes the strength of the Israeli high-tech industry.

For more information in Hebrew Globes

For more information in English Bloomberg